Do Not Disturb: Check-In to India’s Hotel Story

A bite-sized look at how India checks in (and cashes in) — A mini-primer on India's hotel landscape

Hello, Welcome to CAGR Times, My name is Krishna—let’s get started!

Let’s talk about hotels. Not just beds and breakfast, but an entire industry shaped by history, luxury, and new-age travel trends.

A hotel, at its simplest, is defined as “a place where you pay to stay when you’re on holiday or travelling.” Sounds straightforward, right? But we’ll soon see, hotels have evolved—from iconic properties to global chains to new-age formats like hostels and villas.

Well, hotels aren’t exactly a new story. The Romans had their roadside inns, medieval Europe had its taverns, and Asia had caravanserais along the trade routes. But the modern hotel—the kind built for lodging, charging by the room, and offering a predictable standard of service—really took shape only in the 18th and 19th centuries in Europe and North America. And once steamships and railroads shrank the world, the idea spread everywhere.

Ansonia Hotel (The Ansonia), Manhattan, New York | Opened in 1904 | Source: Wiki Commons

The Taj Mahal Palace Hotel, Mumbai, Maharashtra | Opened in 1903 | Source: Past-India

Back in the day, if you were in the hotel business, you had to actually own the hotel. Buy the land, put up the building, hire the staff, run the kitchen—the whole shebang. Heavy capital, heavy risk. Most of the famous names we know today started out this way—grand, family-run establishments by wealthy entrepreneurs. Think Tremont House in Boston (1829), the Savoy in London (1889), or closer home, The Taj Mahal Palace Hotel in Mumbai (1903). They set new benchmarks for luxury and service.

But by the early 20th century, people had a lightbulb moment—why stop at one or two? Why not build a chain of hotels under one brand, so travelers got the same experience everywhere? And just like that, the age of multinational hotel chains was born.

In this phase, hotel companies didn’t just put up fancy properties—they built brands. They owned the hotels, ran them directly, and made sure that whether you checked into New York or London, you got the same familiar experience.

But, do global hotel chains still follow the same playbook? Nope.

As we saw, back in the day, if you were a hotel company, you had to actually own the hotel. You bought the land, built the property, hired the staff, and ran the whole show. Heavy lifting, huge capital, and a lot of risk.

But somewhere along the way, hotel companies realized something—people weren’t really coming for the four walls, they were coming for the brand. If you saw a Marriott or a Taj, you trusted the name. So why spend billions into owning every brick and tile when you could just lend your name, your systems, and your playbook?

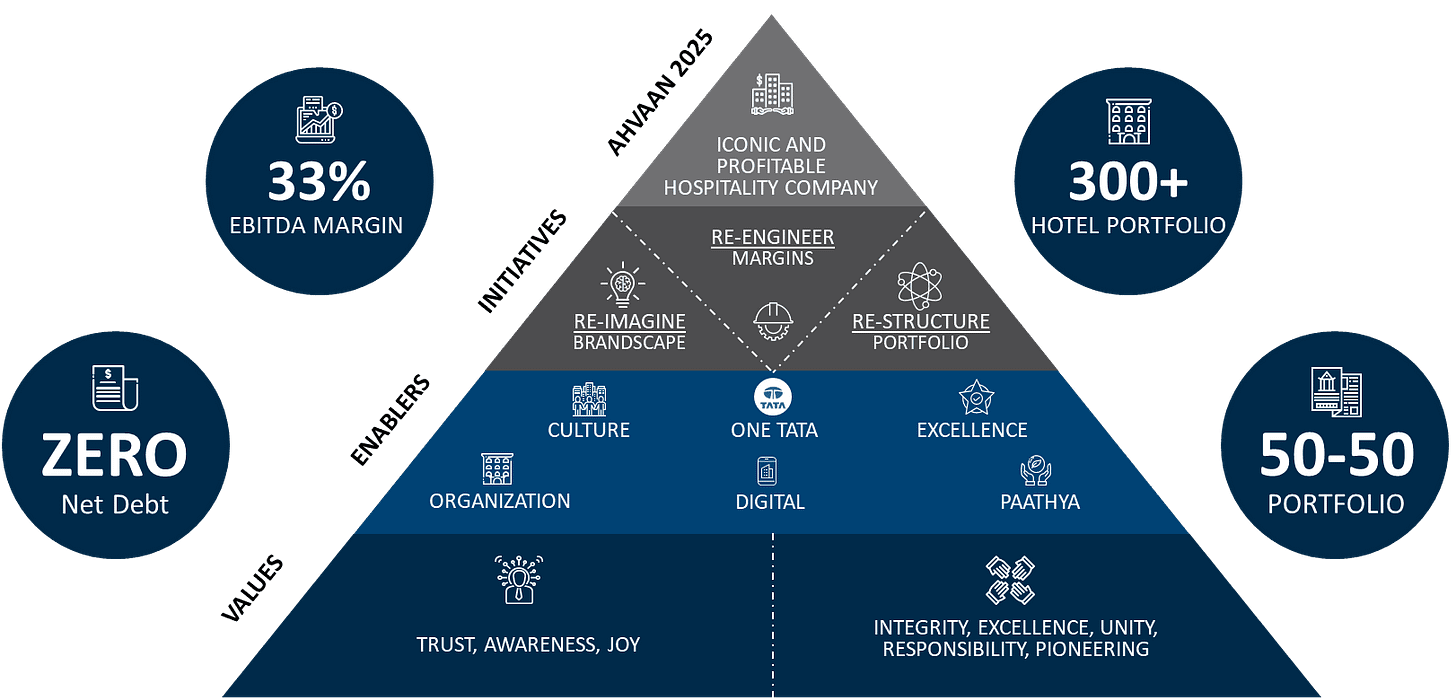

That’s how the “asset-light franchise” model took off. Companies like Marriott, Hilton, Hyatt dominate the hotel industry with thousands of properties globally, but actually owning less than 2% of these properties. Instead, they make their money by charging fees for management and franchising. In India, even legacy players like The Indian Hotels Company Limited (IHCL)—which runs Taj, Vivanta, Ginger, etc.—have jumped onto this wagon. Under its Ahvaan 2025 plan, IHCL wants to achieve a 50:50 mix between owned & leased/ managed hotels.

IHCL's route map for profitable growth: Charting a course towards Success | Source: IHCL Press Release

It’s a win-win: They've shifted from owning beds to owning powerful brands, scaling through partnerships. The brand grows faster, doesn’t burn a hole in its balance sheet, and franchise hotel owners suddenly get access to world-class systems and a big shiny name on their doors.

So, with this you ask; What does India’s hotel landscape look like?

Well, India’s hotel landscape—much like its global peers—isn’t a one-size-fits-all story. It’s a mix of heritage luxury, affordable comfort, and quirky new-age formats. On one end, you have five-star giants wooing business travelers and global tourists. On the other, budget players are standardizing stays for the value-conscious. And in between, a wave of disruptors is redefining what a “stay” even means—whether it’s bunk beds in a backpacker hostel or a private villa for a weekend escape.

India’s hotel landscape can be broken down into three main segments:

The Premium Segment, The Budget/ Affordable Segment, and New-Age Formats.

The Premium Segment

On one side, you’ve got the homegrown titans—IHCL (Taj, SeleQtions, Vivanta) ITC Hotels (ITC, Mementos, Welcomhotel, Storii), and Oberoi (Oberoi, Trident). They’ve been setting the gold standard for luxury stays. Add in names like The Lalit, The Leela, Mayfair, and Club Mahindra, and you’ve got a pretty formidable domestic line-up.

But it’s not just a desi affair. Global powerhouses like Marriott, Hyatt, Hilton, Radisson, and IHG are aggressively planting flags in Indian cities too (A hotel’s brand is also called it’s flag).

The result? A premium hospitality market where heritage blends with global polish—and competition is only heating up as India’s travel boom pushes demand higher.The Budget/ Affordable Segment

Here, the stars look a little different. Think Lemon Tree, Fortune (ITC’s mid-market play), Ginger (from IHCL), Bloom Hotels, Royal Orchid, and Sarovar. They’re the ones catering to value-conscious travelers who still want a clean, dependable room without burning a hole in their pocket.

And then, of course, there are the aggregators—Oyo, Treebo, FabHotels. Platforms that promise standardization in the unorganized budget space by wrapping a brand name on small hotels and selling them online at scale.

Together, these players turned India’s budget segment into one of the fastest-growing corners of hospitality, driven by affordable travel, millennial explorers, and the rise of business & leisure trips to Tier-2 and Tier-3 cities.

New-Age Formats

And then came the new-age disruptors.

Think Zostel, goSTOPS, The Hosteller, Moustache Hostel, and more. They aren’t building hotels in the traditional sense—they are building a culture. A backpacker vibe, a chance to meet strangers-turned-friends, community kitchens, game nights, and yes…those bunk beds with curtains.On the other end, you have brands like SaffronStays, Ekostay, Elivaas, and Ama Stays & Trails—catering to families and friend groups looking for curated weekend villas, vacation homes, and staycations. And with remote work the new norm, many of these formats are positioning themselves as workation-friendly escapes.

Together, these players are reshaping India’s idea of travel. It isn’t just about a clean room anymore. It is about experience, community, flexibility, and Instagram-worthy stays.

One market, three faces, India’s hotel industry isn’t a single story—it’s a spectrum. From global chains to budget innovators to quirky disruptors, all co-existing and expanding together.

With that, let’s Check-In to Growth: What’s Powering India’s Hotel Demand?

India’s travel market is expanding and shifting gears at the same time. From temple towns to Tier-2 hubs, the surge in demand is no longer limited to Delhi or Mumbai. Spiritual tourists, weekend wanderers, and small-town business travelers are now setting the pace.

A Travel Boom Like No Other

India’s tourism revival isn’t just a rebound—it’s a rocket launch. Domestic tourist visits soared to 2.51 billion in 2023, marking a 45% year-on-year surge. Spiritual circuits led the way—Uttar Pradesh clocked ~478 million visits and Tamil Nadu ~286 million. Government schemes like PRASHAD and Swadesh Darshan are pumping funds into temple towns and heritage corridors. Hotel occupancies in Q1 2025 touched 72–74%, while Revenue per Available Room (RevPAR) surged to Rs 7,600. But demand isn’t just about numbers—it’s about standards. More Indians now prefer to spend a bit extra for a branded experience (ETHospitalityWorld, HVS-Anarock Report)

It’s not just a metro story anymore

The next growth wave isn’t just urban—it’s off-metro. As of March 2024, there were already 1.8 lakh branded rooms in play. And over the next five years, another 80,000 keys are set to join the mix. The kicker? Half of this supply is already under construction—a strong thumbs-up from investors betting big on the sector.

But the real action is happening outside the big cities. Over half of the new supply is in the upper midscale and midscale segments (The Budget/ Affordable Segment), and much of it is rising in Tier-2 and Tier-3 cities. (CARE Ratings)Why? Because Tier-2 and Tier-3 cities are buzzing with spiritual tourism, weekend getaways, and budding business flows. And travelers in these smaller towns don’t want bare-bones stays anymore. Consumers are trading up from unbranded lodges to affordable, branded options. They aren’t seeking Taj-style luxury—but they do want the reliability and loyalty perks.

That’s the premiumization drive for you: travelers willing to pay a little extra for clean, standardized stays that feel a notch above the local lodge.

The Indian hotel market is being redefined from the ground up. The next 80,000 rooms won’t just serve big-city corporates, but also pilgrims in Ayodhya, professionals in Coimbatore, and families in Jaipur.

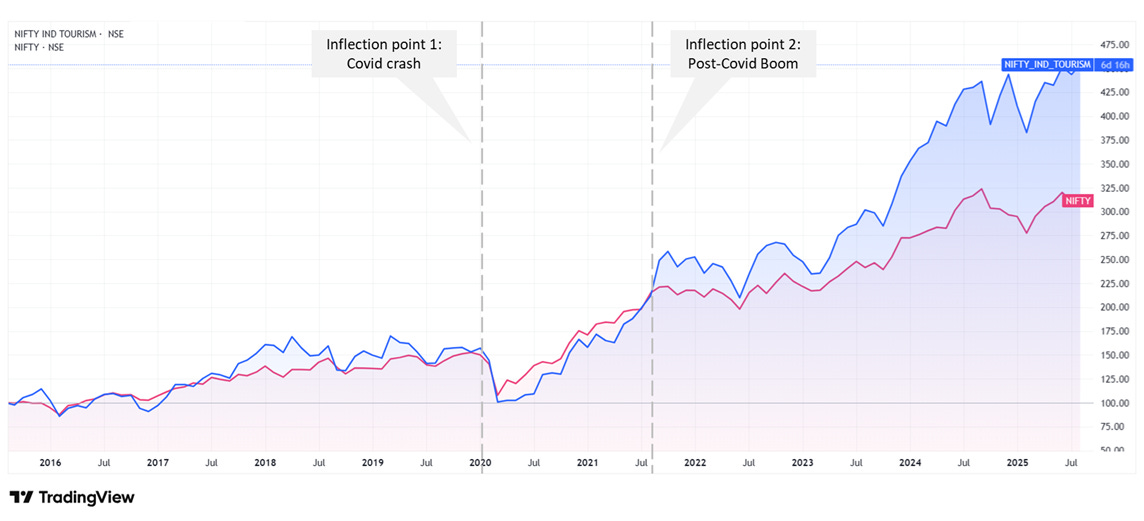

Public markets are already taking note

India’s travel boom is big business, and the stock market isn’t missing it. The Nifty Tourism & Hospitality Index has been outperforming the Nifty 50—a clear vote of confidence from investors, particularly in midscale and standardized hotel chains. Players like IHCL, Lemon Tree, EIH (Oberoi Group), Chalet Hotels are reaping the benefits, backed by strong pipelines in the affordable-premium space. Add to that global chains doubling down on India, and it’s clear—this isn’t just a post-pandemic rebound. It’s a structural travel boom, powered by a premiumization wave that’s reshaping the sector.

Index used: Nifty 50 & Nifty India Tourism Index; Coverage: Past 10 years from August 2025; Values indexed to 100 for comparability | Source: TradingView

Pre-Covid (before Inflection point 1), the Nifty Tourism Index more or less moved in lockstep with the broader Nifty 50—nothing unusual there. But post-pandemic (after Inflection point 2), tourism stocks didn’t just bounce back—they raced ahead, a clear signal of investor appetite for hospitality-driven growth.

In short, the tourism index’s post-Covid outperformance isn’t a flash in the pan—it’s anchored in a robust revival of demand, higher room rates, and sustained revenue growth. That, in turn, is fueling India’s hotel sector—both directly through stays and indirectly via ancillary consumption—making it a standout narrative in today’s markets.

With domestic leisure demand surging, India's branded hotel occupancy reached a decade-high, that surge isn’t coming out of thin air.

At the end of the day, a hotel may just be “a place you pay to stay.” But in India, it has become so much more—an industry built on heritage palaces, global chains, budget innovators, and quirky new-age formats. It’s riding a travel boom that’s shifting beyond metros into Tier-2 and Tier-3 cities, powered by premiumization and investors piling in.

So whether it’s a consultant in Coimbatore, a pilgrim, or a backpacker in Manali—India’s hotels aren’t just offering rooms anymore. They’re offering a front-row seat to one of the country’s biggest growth stories.

Important disclaimer: This article is for educational purposes only. Views expressed are personal and do not constitute investment, financial, trading advice or recommendation.